The details of your loan-- your home loan price, terms and various other contracts-- will certainly not alter if your home loan is marketed by your existing lender. Those details are locked into your agreement as well as will certainly stay the same as they did on the day you shut on your residence There are 2 primary types of home mortgage capitalists that could get your home loan-- government-sponsored entities as well as government firms. You may be wondering what mortgage capitalists relate to you when you acquire a house. The reality is, home mortgage capitalists maintain the property market running in methods you http://finnogxe073.almoheet-travel.com/existing-home-mortgage-rates most likely didn't even recognize-- and sometimes, they can impact the maintenance of your current mortgage.

- This would restrict the amount of funding offered for people to obtain residences.

- As you remain to pay on your home mortgage, Fannie Mae and also Freddie Mac utilize this money to pay back the financiers who purchased their safeties.

- Issuances of private-label mortgage-backed safeties increased considerably from 2001 to 2007 and then ended suddenly in 2008, when realty markets started to falter.

- ARMs commonly have restrictions, or caps, on how much the rates of interest can climb each time it readjusts and in complete over the life of the loan.

- Mortgage are bought from financial institutions as well as various other lending institutions, and possibly designated to a special function car.

We believe by providing devices and also education we can help people maximize their financial resources to reclaim control of their future. While our short articles might include or include select companies, vendors, and also products, our method to compiling such is equitable and objective. The content that we develop is totally free and also independently-sourced, lacking any type of paid-for promo. If you have a complaint or question regarding the transfer of your lending, you have a lawful right to send a created request or note to your previous loan provider. " Customers need to not be collateral damage in the home mortgage maintenance transfer procedure," stated Customer Financial Security Bureau Supervisor Richard Cordray. You'll intend to read the initial home mortgage statement you obtain from your brand-new lending institution very Check out the post right here carefully-- verify that all the details it notes holds true and also accurate.

Evaluating A Mortgage Offer

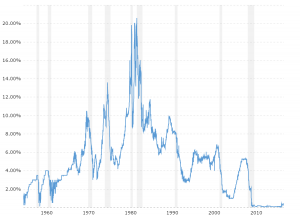

As part of the market movement around COVID-19, mortgage rates had been up to record lows prior to increasing once more lately. On the other hand, even more customers have actually needed to apply for forbearance because of illness or industry shutdowns associated with the virus. On the various other hand, if you want to hug expenses down, you can opt to take a credit score from your lending institution to roll the closing costs into the finance in exchange for a somewhat greater rate. The stock and also bond markets have a tendency to run with a push-pull impact. Supplies are taken into consideration riskier due to the fact that they are fed by corporate profits outcomes as well as, usually, by speculation on what a firm will or won't succeed off right into the future. They're rather much more speculative, yet they can use a greater price of return for the boosted threat.

Home Mortgage Help And Assistance

These are home loans that a lending institution keeps their own publications, or offers them to investors they have a direct partnership with, rather than funneling them with Fannie Mae, Freddie Mac, the FHA or another agency. Relatively couple of loan providers supply them - you typically require to call your regional USDA workplace to get a listing. But if you're a newbie homebuyer who falls within the income limitations as well as various other qualifications, these no-money-down lendings are tough to defeat. Your routine bank isn't most likely to tell you regarding mortgage options they don't offer. Yet various other lenders might provide car loan items that are a much better suitable for your demands. Discount factors, usually described simply as "factors," are a specific type of charge that are entitled to a different description.

Your solution won't be cut off and you likely will not also discover any type of differences. Your lender will certainly send you a letter if your home mortgage adjustments financiers, with all of the details info regarding this transaction, and will note that your servicing will certainly continue to be the same. The sale of your funding doesn't impact the collection of repayments, so when your financing is sold, you shouldn't observe a distinction from a practical point ofview. You'll maintain making your repayments to your servicer, which might or may not be your original lender. If you Discover more have automobile draft or costs pay established through your bank, change the payment days, addresses, and account numbers to mirror your new servicer.

Nevertheless, borrowing is risk-based, as well as individual variables like your credit report, deposit and also the sort of home you're purchasing have a significant effect. As soon as you have actually closed your funding, home loan investors buy the financing and provide fresh liquidity for the market. The differences in structure of conventional banks and darkness banks bring about 2 types of division in the home loan market. First, the stricter funding demands as well as larger governing burden standard financial institutions encounter put them at a competitive downside in the adhering loan market.